The inclination towards this idea of a financial fast has been swirling in my head for a while now—since my friend

told me about her no-spend months from August through December, since before the onslaught of Black Friday emails, since the first of innumerable gift guides came out.Which is to say, this financial fast has been a long time coming.

I told my husband that maybe I’d start this on December 1, or on my birthday, December 7. An interesting way to start my new year, I said. Who are you kidding, he said, and he took me on a little family birthday getaway and spent good money booking a breakfast horseback riding experience for me and my two oldest boys on the morning of my actual birthday. I woke up while it was still dark, put on the hotel’s shearling lined robe and made myself a cup of “cowboy coffee” that I sipped in the stillness and quiet of the living room. It was the best start to a wonderful day, a wonderful weekend, and my 38th year.

Which is to say, I also believe money can buy meaningful experiences.

Both things are true and good: refraining from spending money in order to gain clarity and practice stewardship and using money to celebrate life and strengthen family bonds.

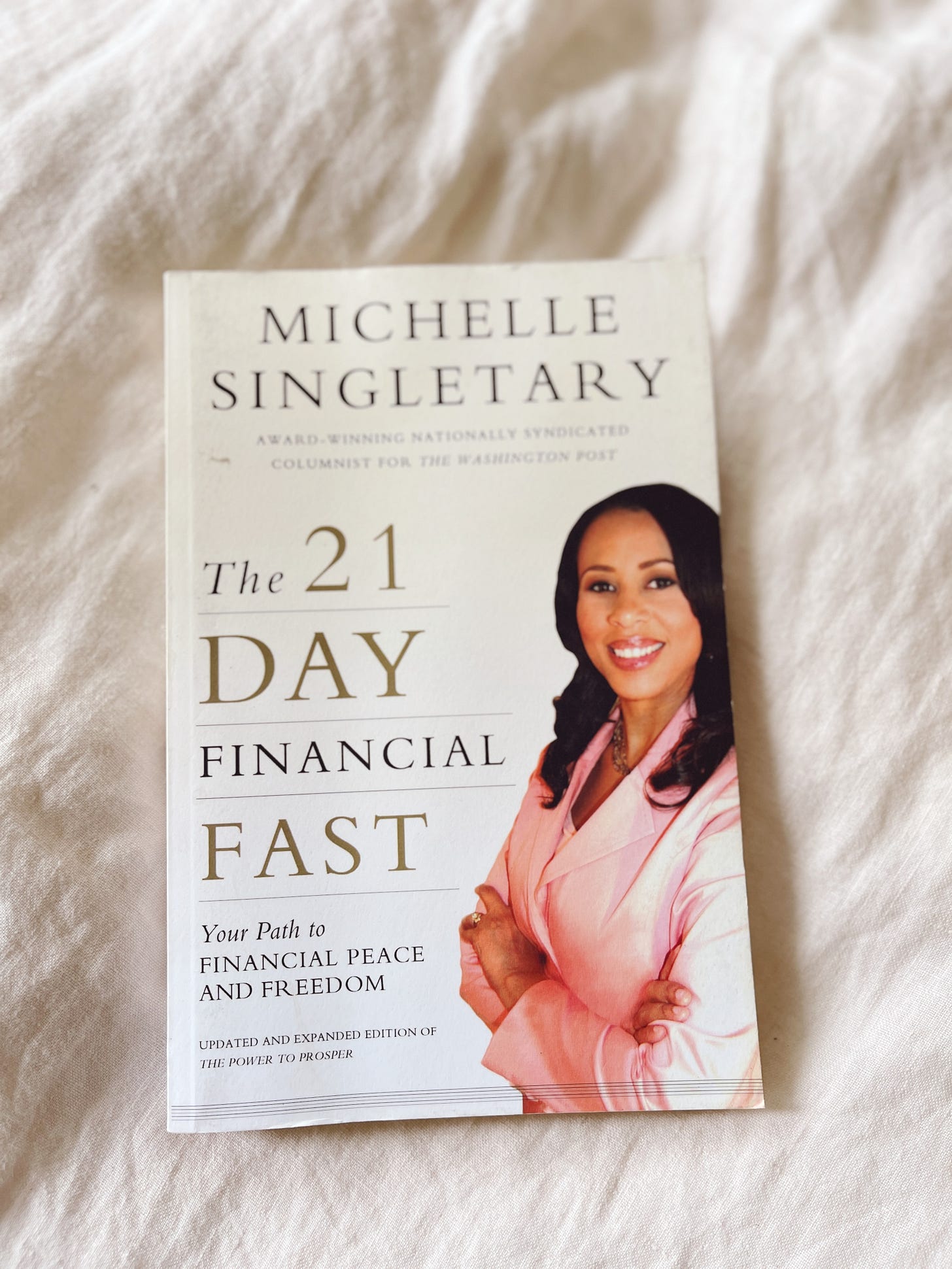

When I picked up Michelle Singletary’s book, it was after I read several of her columns in the Washington Post, to which I have a subscription. I sent several of these articles to my husband, including one where Ms. Singletary shares how she and her husband put their three kids through college so they could start their adult lives debt-free. I first listened to the book on my Libby app in November then bought a physical copy of The 21 Day Financial Fast.1

As I’ve read more and prayed about my goals for 2025, I’ve come to the conclusion that a 21-day financial fast is my next best step.

I love that The 21 Day Financial Fast is grounded in scripture. This may be off putting to some, but for me, it’s reinforcement of deeply held beliefs and values. It’s like a dry January or a “no buy” month, but this is a spiritual fast as much as it is a financial one.

I recently read Justin Whitmel Earley’s book The Common Rule: Habits of Purpose for an Age of Distraction, and related to fasting, he writes:

“The point of fasting is not the technicalities of it. The point is leaning into the lack, and this can be done in many, many ways, all of which are radical acts, especially in America. Here, fasting is bizarrely countercultural because it runs the opposite direction of the American dream. In pursuit of the dream, we tell each other that we can move upward in the world through sheer individual effort and that we’re going to finally be happy when we get there. In fasting, we deliberately move downward into emptiness—and even more, we can’t eat or work our way to happiness. We need God for that.”

He goes on to say:

“Fasting is to let your desires hang out in the open, where you can observe them. In combination with prayer, this often leads me to a kind of spiritual clarity that is impossible without the act of fasting. I see more who I really am, and I feel more of who God really is.”

My Why

We need to calibrate our consumption. Our house is overflowing with … stuff? … and I know we have four kids and that’s par for the course in some ways, but also, it’s a lot to manage, and I think we would all be just as happy with less.

It’s countercultural to embrace enough. It’s countercultural to be inundated with ads for various ways to level up your life with the click of a button and free two-day shipping and still say, no, I’m good.

This fast is an exercise in clarifying our financial priorities. When we’re only buying what we need, we’re clearing mental space to think about where we really want that money to go in the future, like home improvements and family vacations.

I want to practice believing that God will provide us what we need. My dad talks often about “buying without money” (Isaiah 55:1), but really, I’ve seen this come true in my life more times than I can count. I want to count the ways God meets our needs over these 21 days.

We need to use what we already have. We have food in our pantry, unopened toys in our closets, and closets filled with clothes. We have so much!

I’m also taking a break from Facebook and Instagram (the ads! the influencers!) because it’s not just about taking a break from shopping, it’s about taking a break from being sold on so many different things. It’s about taking a break from buying the lies that we constantly need new and better things to be happy.

As Michelle Singletary writes:

“I want you to understand that you have so much already. I want you to take your prosperity seriously by consuming less, shunning debt, and organizing your financial life.”

The Plan

The parameters that Michelle outlines in her book are straightforward:

Don’t buy what you don’t need

Stop using credit cards; use cash whenever possible

Refrain from window shopping/online shopping

Don’t buy meals outside the home

On needs v. wants

Groceries for us are a need, naturally, but the cookies, Olipops and bottles of wine I might pick up at the grocery store are not needs. Clothing for our kids *might* be a need (how do they grow so fast?!), but clothing for me is definitely a want.

On online shopping

I actually love that as part of the fast, you refrain from even looking. Because I can personally attest to how many hours of my life I’ve probably lost scrolling through Shopbop trying to find the perfect dress or pair of jeans.

On not eating out

This one is going to be the hardest. So many friend dates revolve around going out to eat, and the main break I get from cooking are the meals we eat at restaurants. Easy frozen dinners and snacky meals (hard-boiled eggs, apple slices, and carrot sticks) are going to come to the rescue.

The 21 Day Financial Fast book includes readings, testimonies, and assignments for each of the 21 days. I plan to do these and journal through the fast in my prayer journal.

I am genuinely so very excited about what God is going to reveal to us in this pause. He’s working in our lives all the time caring for us and providing for us, and I want to take the next three weeks to pay closer attention.

Let’s Go

I love the fresh start energy of January, so it feels fitting to start the month off with a challenge to reset our hearts (and wallets) against the consumerism, excess, and “too-muchness” that December likely brought. Our routines go back to normal next week when the kids go back to school, so if you want to join me, the fast starts on January 6.

Related Reading

Have you done a financial fast or something similar like a “no buy” month? Share in the comments!

No affiliate links here! I’m not opposed to them in general, but including affiliate links here feels incongruous to the heart of this post.

I'm very intrigued by this and look forward to reading more! Laura's No Spend for Fall 2024 encouraged me and it felt so good to do. Not *quite* ready to do another spending challenge right now, but definitely want to do one again!

Yes! I'm doing a version of this (Nancy Ray calls it a contentment challenge - she has more info about it on her blog). God's really been convicting me of my spending habits so it's a long time coming! Thanks for sharing your approach to this!